The digital age has brought about a significant shift in the way we access financial services. With the use of technology, financial transactions have become seamless, convenient, and reliable. Bajaj Finserv, a leading NBFC, has been at the forefront of this transformation by providing customers with a wide range of financial products and services.

One of its most popular offerings is the Bajaj Finserv Insta EMI Card, which has revolutionized the way customers make purchases and repay them in easy installments. In this article, we will provide a comprehensive guide on how to use Bajaj Finance online payment and how the Bajaj Finserv Insta EMI Card can enhance the online payment experience.

Understanding Bajaj Finance Online Payment

Bajaj Finance online payment is a simple and convenient way to pay your dues from anywhere, anytime. Here are the steps you need to follow to make a payment online:

1. Visit the Bajaj Finserv website: To make a payment, you need to go to the official Bajaj Finserv website.

2. Click on “Customer Login”: Once you are on the website, click on the “Customer Login” button on the top right corner.

3. Enter your details: You will be required to enter your registered mobile number and customer ID to proceed.

4. Choose the payment option: Once you are logged in, click on the “Pay Now” button, which will take you to the payment page. Here you can choose the payment option of your choice, such as credit card, debit card, or net banking.

5. Enter the payment details: Enter the payment amount, select the payment mode, and enter your card or bank details.

6. Make the payment: Once you have entered all the payment details, click on “Pay Now” to complete the transaction.

Bajaj Finance online payment is a quick and secure way to make payments for your loans, credit card bills, and other services. You can also set up automated payments to ensure that your bills are paid on time each month.

Maximizing the Online Payment Experience with Bajaj Finserv Insta EMI Card

Bajaj Finserv Insta EMI Card is a payment card that allows customers to make purchases and repay them in easy monthly installments. It comes with a pre-approved loan limit, which you can use to buy products from a wide range of online and offline partner stores. The Bajaj Finserv Insta EMI Card offers several benefits that can enhance the online payment experience:

1. Instant Approval: Bajaj Finserv Insta EMI Card comes with instant approval, which means that you can start using the card immediately after you apply for it.

2. No Cost EMI: Bajaj Finserv Insta EMI Card allows you to purchase products at no extra cost. This means that you only pay the product price in easy monthly installments, with no interest or processing fee.

3. Flexible Repayment Options: Bajaj Finserv Insta EMI Card offers flexible repayment options, which means that you can choose the repayment tenure that suits your financial situation best. You can choose a tenure ranging from 1-60 months.

4. Wide Range of Partners: Bajaj Finserv Insta EMI Card has tie-ups with over 1.5 lakh+ online and offline partner stores. As a result, you can use the card to purchase products across various categories such as electronics, appliances, fashion, furniture, and more.

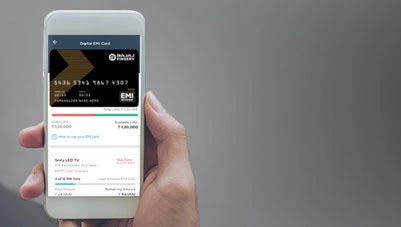

5. Easy Digital Access: Bajaj Finserv Insta EMI Card provides easy digital access through the Bajaj Finserv Wallet App, where you can view your card details, transaction history and pay your EMIs.

Using the Bajaj Finserv Insta EMI Card also gives you access to exclusive offers and discounts at partner stores. This means that you can save money while making purchases and paying in easy installments.

Conclusion

In conclusion, Bajaj Finance online payment and Bajaj Finserv Insta EMI Card are two powerful tools that can make your financial transactions hassle-free and easy. With Bajaj Finserv Insta EMI Card, you can make purchases at no extra cost and pay in easy installments. It comes with a pre-approved loan limit and instant approval, making it a great choice for individuals looking for a convenient way to make purchases. Bajaj Finance online payment, on the other hand, is a quick and secure way to pay your bills from the comfort of your home. By following the simple steps outlined in this guide, you can master the art of Bajaj Finance online payment and enjoy a hassle-free financial experience.